Started

Started

Started

Home / Resources / Knowledge base / Getting started

Getting started

Get started here! Step-by-step guide to using Kiiper.

Getting started

Get started here! Step-by-step guide to using Kiiper.

No results found.

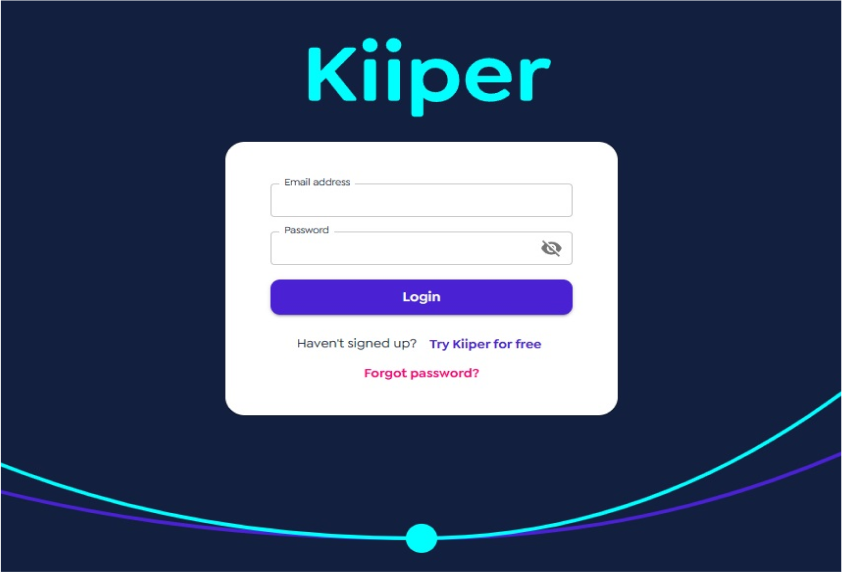

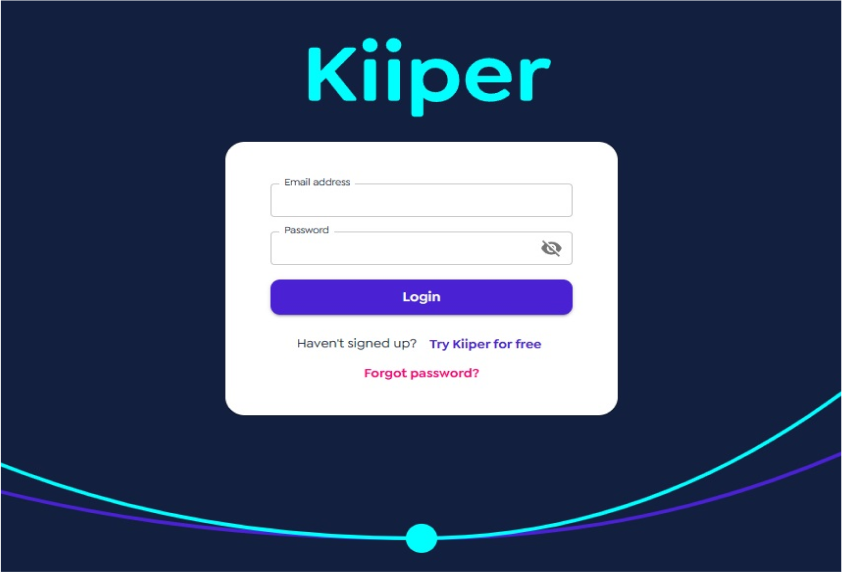

How to access Kiiper?

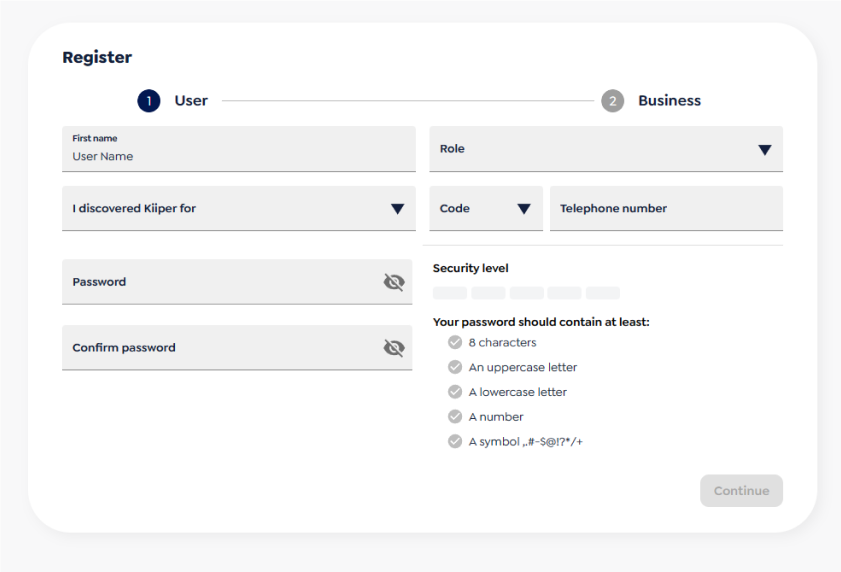

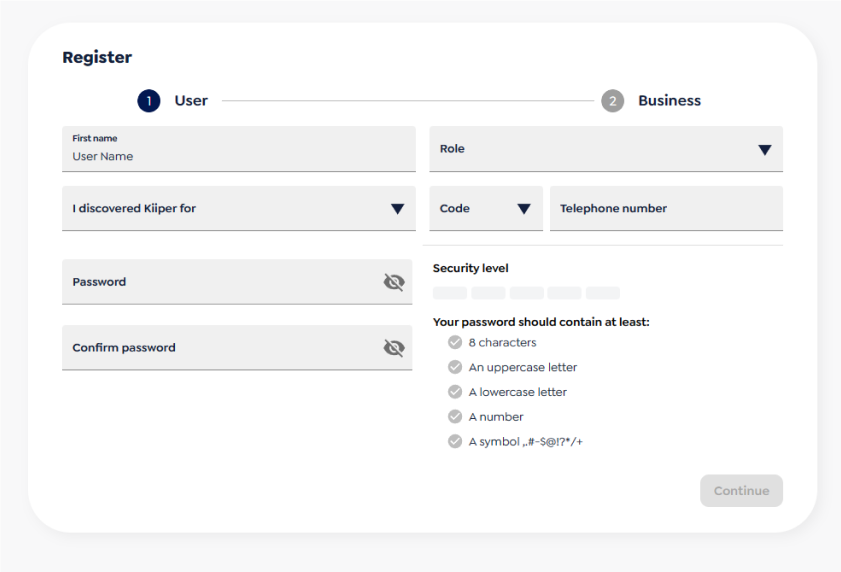

How to create a Kiiper account?

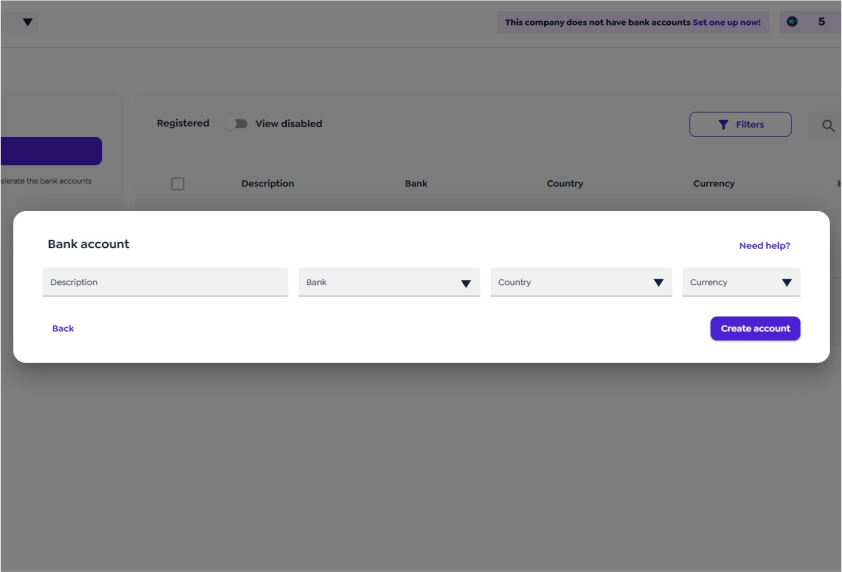

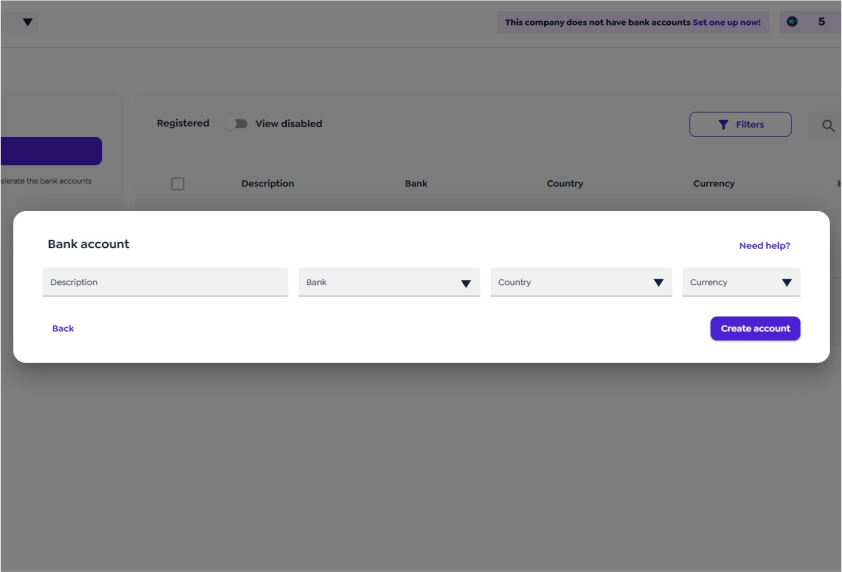

How to register bank accounts in Kiiper?

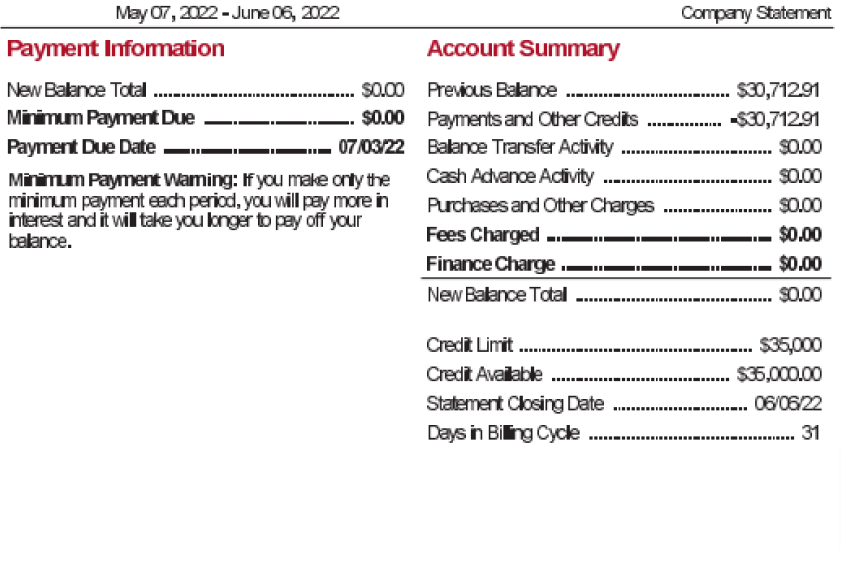

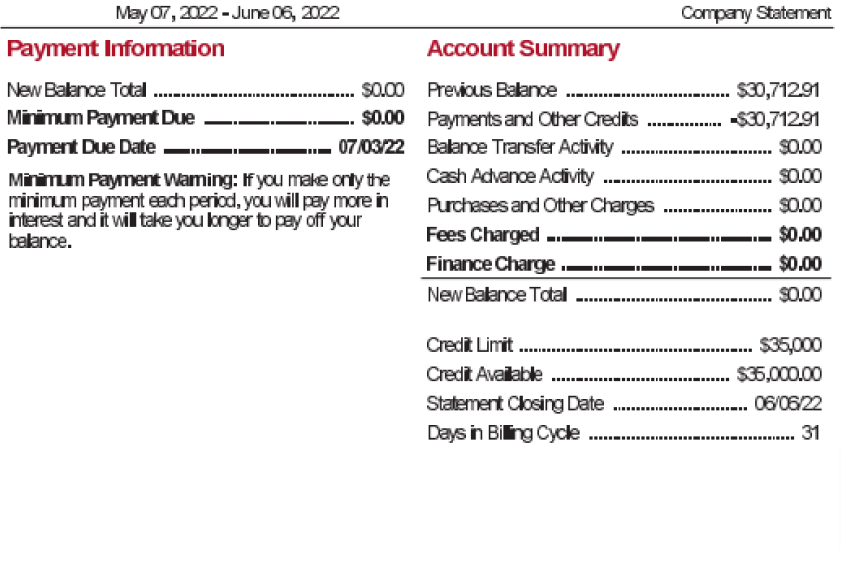

How to download a searchable bank statement?

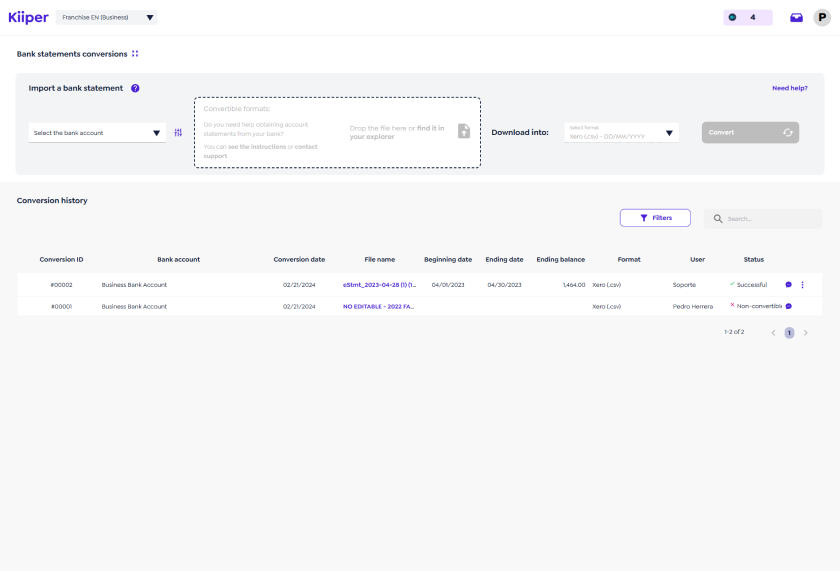

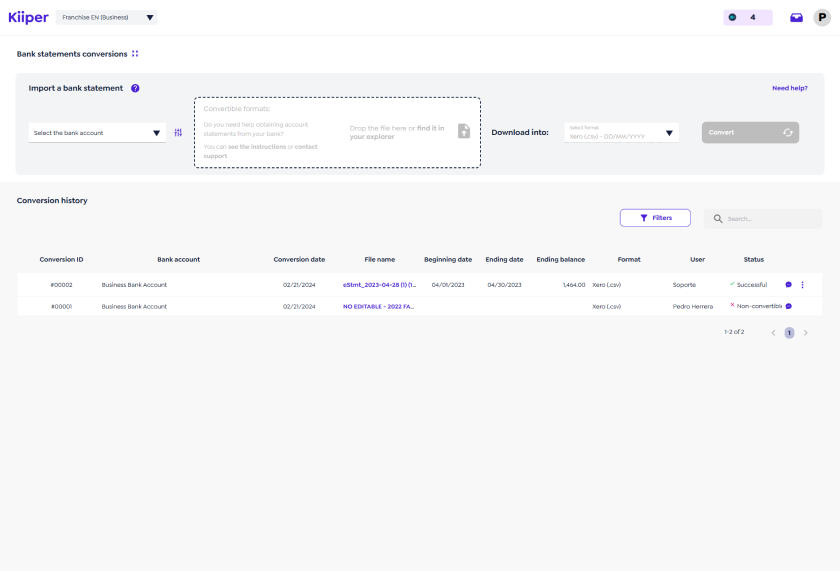

How to convert a searchable bank statement in Kiiper?

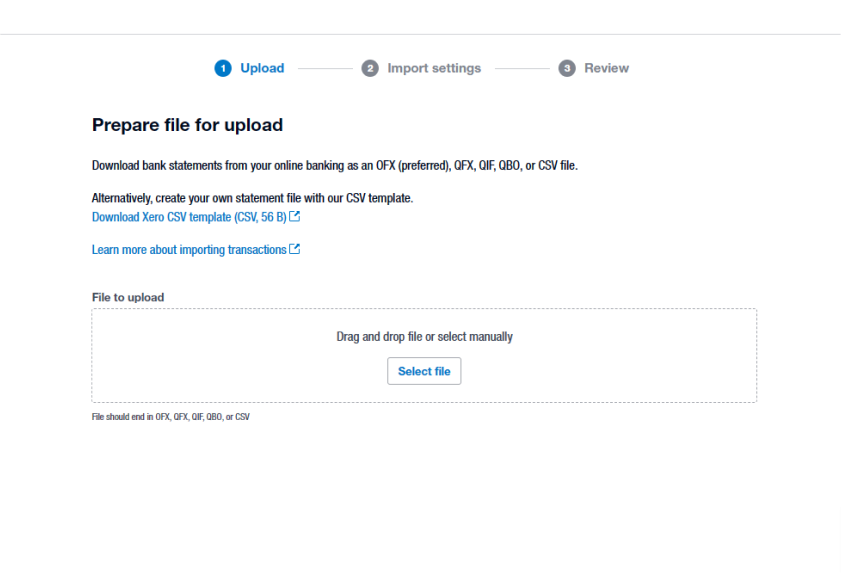

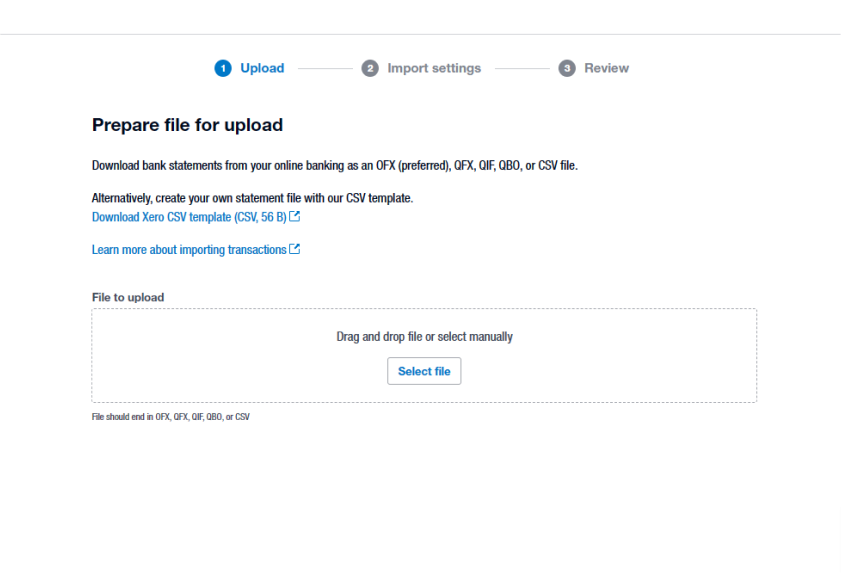

How to import bank statement into accounting software?

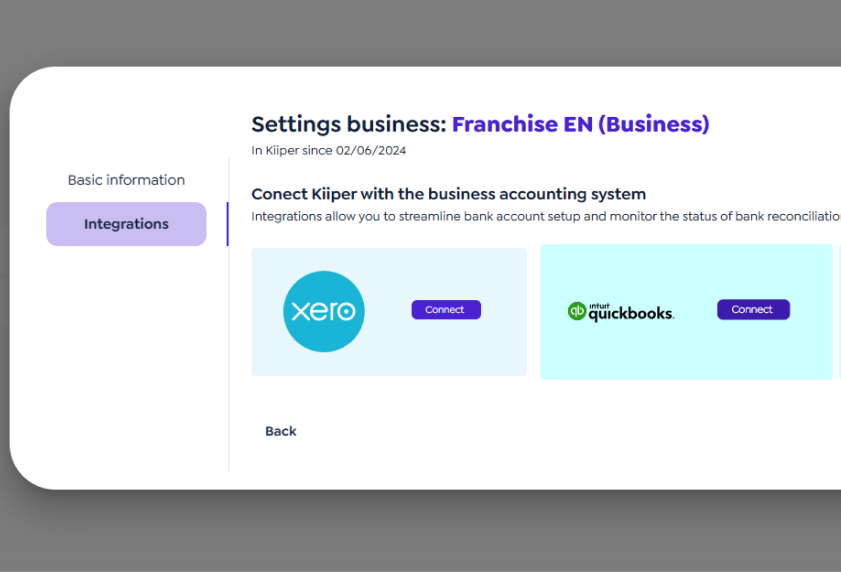

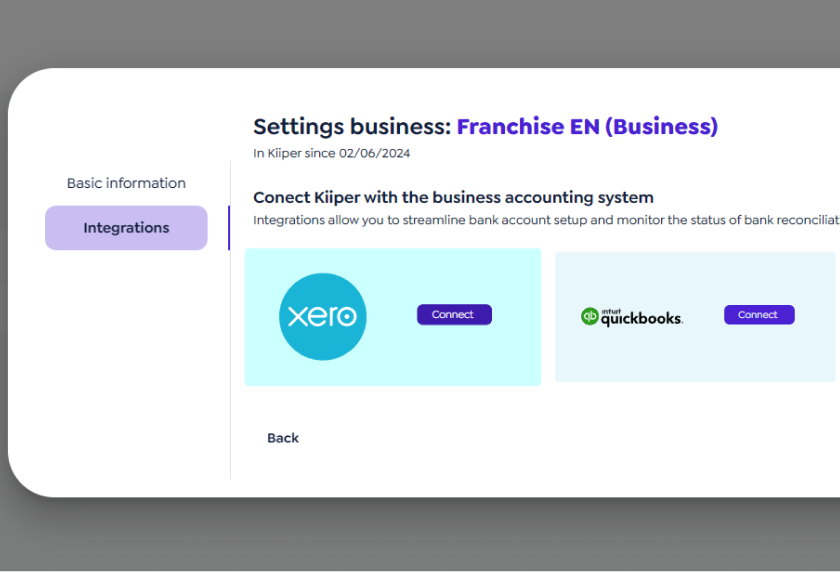

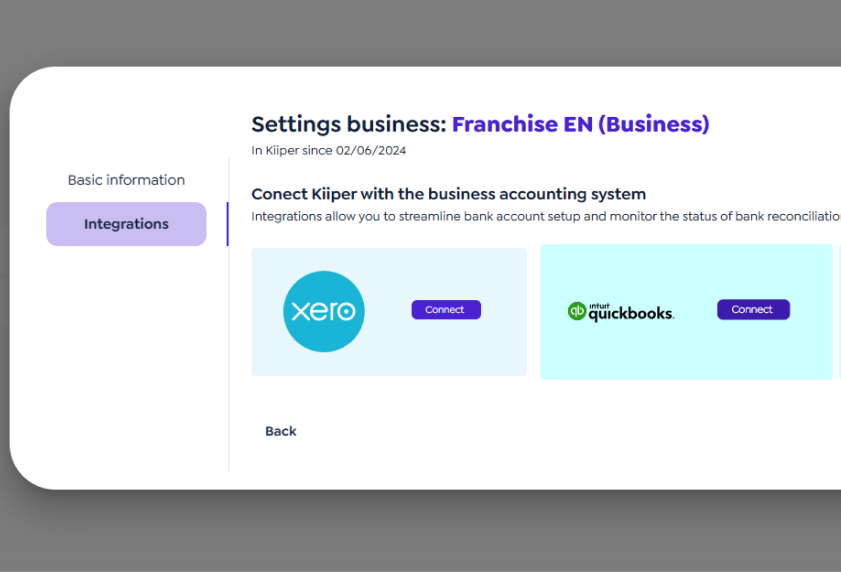

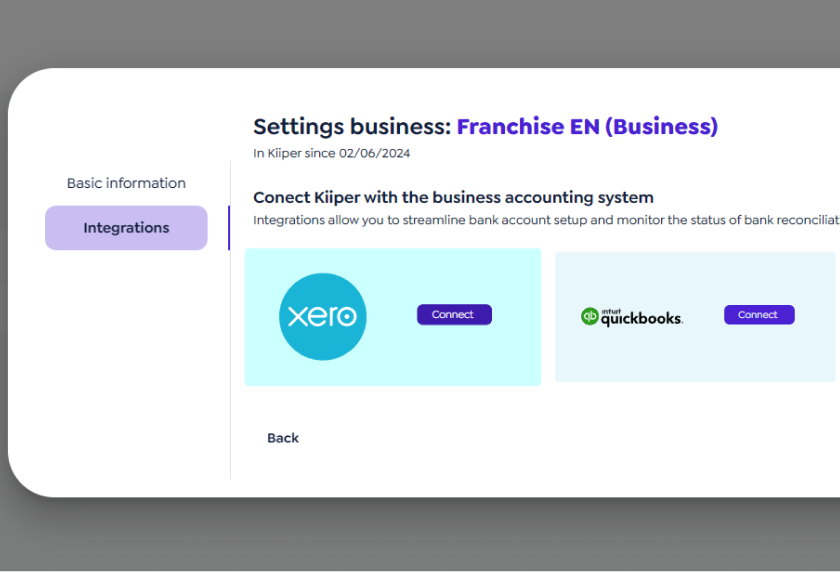

How to integrate Kiiper and Xero?

How to integrate Kiiper and QBO?

No se encontraron resultados.

How to access Kiiper?

How to create a Kiiper account?

How to register bank accounts in Kiiper?

How to download a searchable bank statement?

How to convert a searchable bank statement in Kiiper?

How to import bank statement into accounting software?

How to integrate Kiiper and Xero?

How to integrate Kiiper and QBO?